Emerging discussions

Automating or enabling

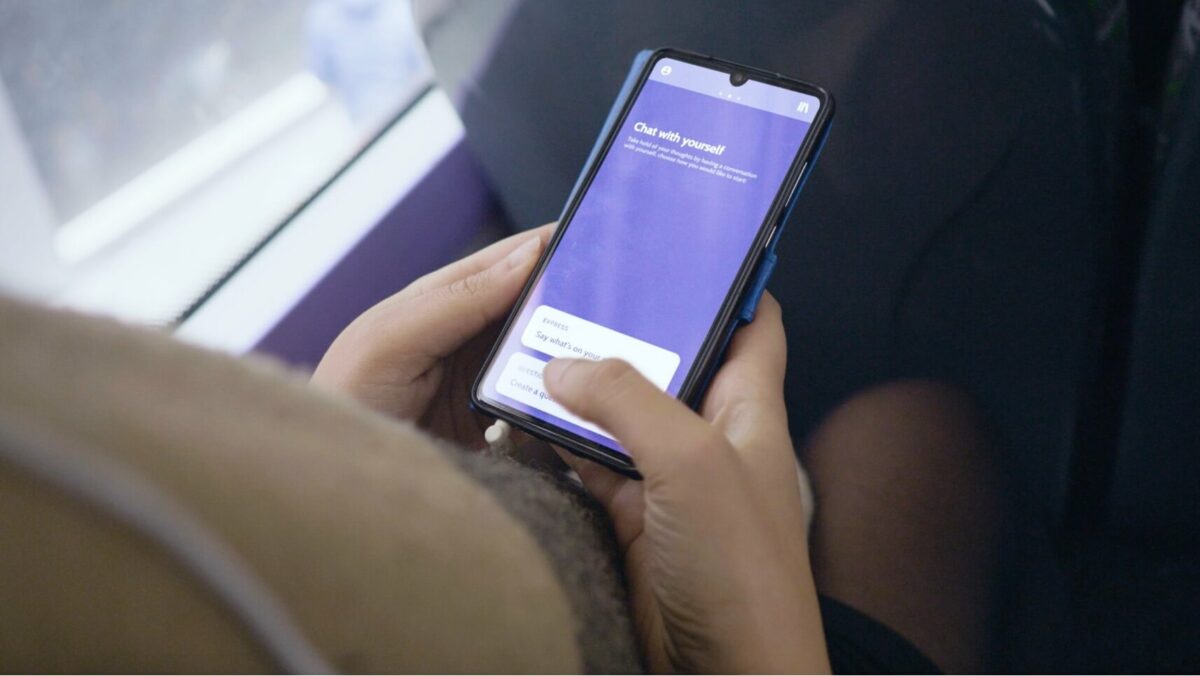

Within app development discourse, there is a logic that users must get quick value to maintain engagement until a user is invested enough to stick with the service and continue giving it time or even money. This approach is also validated in Quirk. As we previously discussed, users needed to be shown quick value from a self-discovery quiz before embracing the app. It became more challenging in its objective to educate people. While this process can be made fun, it still requires people to make their own decisions to work through some sort of learning cycle where they have to take action in order to learn, which wouldn’t happen if the service was purely automated.

Making decisions is something that many new financial technology services are targeting as a problem and are actively removing from the user experience.Does this represent a threat to genuinely enabling financial services? Does this dampen people’s willingness to engage in a service that has a higher expectation of them? Or is Quirk an indication that there is a growing appetite in the market for services that give people enough respect to make their own decisions and value the longer term educational benefits?

While some research now demonstrates that giving users some element of choice actually improves their engagement with a service, it is not clear how much choice is engaging and how much is considered laborious. Financial education services like this, will need to find a positioning that is automatic enough not to be laborious or boring, but offer enough choice that it is still educational. Some things should be easier and predetermined for the user, but for other things it is more powerful if the user decides, for instance, how much money to save each month.

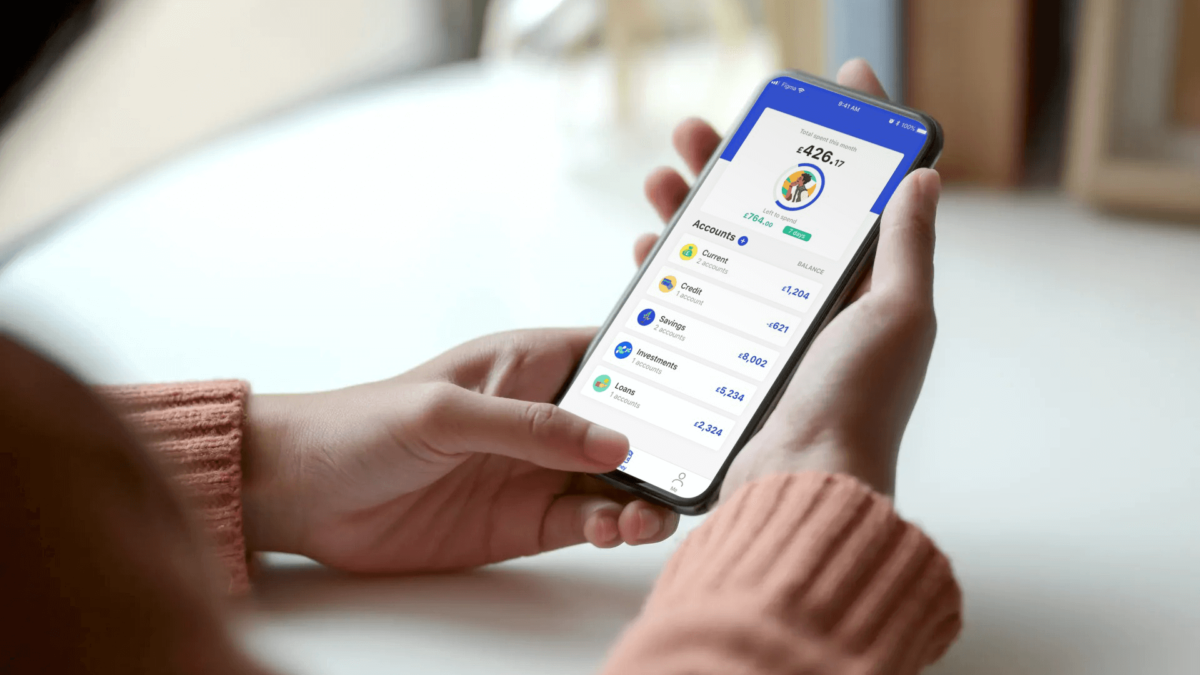

Fin tech industry is segmented across products and services

Another interesting consideration, which emerged from analysing the market as Quirk developed the product, was thatost fintech startups focus solely on one specific feature that they can deliver exceptionally well and then they expand into other features and other offerings later. This approach seems to contradict one of the founding considerations of the Quirk service, which is that people don’t think of their finances in terms of distinct banking features and products, they see them more holistically. Quirk has to balance not being stretched too thin by offering everything to everyone, but also finding the right balance in offering people a holistic view of their finances.

Humans are better

Another consideration arising from the process is about the right moment to introduce humans to the service. It is undeniable that human financial advisers are currently far superior to any automated advice service. For this reason, when a user’s requirements become too complex they would be referred to a human Quirk advisor.

The interesting discussion is about when a human service should be offered and how it can be integrated with digital advice. Most people using the service are doing so because they can not afford an advisor or they feel their needs are not complex enough to warrant it. Can the use of digital financial services reduce the cost of giving one-on-one advice? Can they make the one-on-one advice more personalised when they do? And can they be used to enhance the implementation of whatever human advice was given?

The right amount of engagement

Investors typically look at the number of users who are active on the service everyday as a good measure of engagement and therefore the value of the business opportunity.This perception is aligned with ideas that people‘s screen time with a service is akin to the value they take from it. However, rapid and quick interactions with people’s money does not necessarily promote wellbeing and even worse can promote anxiety. Quirk, in its current form, essentially enables people to be more aware of how they are spending their money and then act on this. If people are constantly nudged to engage with the service through prompting messages and alerts, it could trigger people who are already concerned about money to constantly monitor their spending.

The service will have to establish ways to validate their principle that money should not be all-consuming, in fact, that the service could be more successful if it carefully avoids inducing anxiety by raising awareness in the right ways, looking for infrequent quality time rather than higher frequency quick moments.